Members Update: Our AAPL Call Spread Options for this Pullback & our AAPL Forecast Model Continu

- Momentum Stock Alerts

- Jun 20, 2017

- 8 min read

NEAR TERM FORECAST

Apple's strong rally today has clearly invalidated the forming descending triangle that has been developing on the 10-minute chart (see below) and if the stock moves another $1.50 off of current levels ($146) then it could end/invalidated the entire sell-off. The $147.50 represents the top of the recent consolidation zone. That zone is actually technically bearish since it is coming off of a downtrend. But with how strong today's action is I would say that it is really neutral at this point. Apple will eventually either breakout above $147.50 which essentially ends the correction or it will lose the $142.00 level and continue to a new lower trading range. At this point, the bulls don't have total control but today puts them ahead quite a bit because Apple fell to its absolute support on Friday and the bears couldn't muster the negative sentiment to lead to a gap-down today. So the ball is in the bulls' court at the start of this week. It's very atypical to see this type of action. You don't normally get radical selling momentum going into a weekend and then get the exact opposite momentum on Monday. Monday are known for counter trend pivots in direction but not when the the preceding momentum is as strong what we saw last week.

Note again the red line represents the breakout point for Apple and the blue line the breakdown point.

Also, as we mentioned last week, what we're likely to see here is a new consolidation zone that allows AAPL to create a new base/breakout pattern in the larger continuation of this macro uptrend. As of now, in no way do we believe that AAPL is entering a macro bear cycle. AAPL is in a macro bull cycle. This pullback period is one that should create congestion & volatility as AAPL bounces a bit & fleshes out a new "continuation pattern."

What we want to see here is AAPL flesh out a new breakout pattern. If AAPL breaks higher this week above $147 a share then we can expect AAPL will revisit the $156 high. From there we would sell our entire 2019 AAPL Jan 110/120 call spread around $9.60 to $9.75 and then expect that AAPL will pullback yet again to retest the $142.20 lows that were printed on this recent pullback. From & around there...we'll be buying a new call spread in the conservative category. We expect AAPL will very much build a new consolidation pattern where it gets to recharge, setup & base with little "OMG" days where it feels like it's all about to end and then inevitably breakout higher. Like this is what's happened COUNTLESS times on AAPL while it's gone on mega bull runs. It pauses & sets up. Again, notice the 2015 consolidation/pullback phases that AAPL went through. This was the 2015 rally where AAPL went up 144% higher from the lows of 2013.

2015 RALLY PULLBACKS

2015 RALLY PULLBACKS of -12.39% & -8.17%

So in this 2015 pullback, AAPL declined -12.39% as we can see above.

Now here is where AAPL currently stands. From peak to trough of this near term pullback, AAPL has declined -9.24%. That's very similar to the pullback of 2015 at -12.39%. So we're close but no cigar just yet. We want to see AAPL at least get down to the $138 area before we get into our next call-spread. AAPL reaching $138 would also coincide with a -11.70% pullback & reach the 61.8% fibonacci retracment level. Take a look below on AAPL's current standing:

Btw, also in the 2015 rally that -12.39% pullback coincided with a 61.8% fibonacci retracement level. AAPL reaching $138 in the current setup would fulfill a 61.8% retracement. So we still think this is likely.

OUR CALL SPREAD STRATEGY ON AAPL

You'll notice through all this that our current AAPL call-spread is up almost 130% right now.

We will be selling that call spread as this bounce materializes towards the retest of the $156 area. We believe that the $156 area will fail on the first try back up. So we'll do our selling around there and then look to buy our new call spread back down towards a retest of the $142 lows. We expect AAPL will have a very short breach of the $140 level. Depending the quality of the setup we may enter our next call-spread right around there or lower...it will depend how the action & indicators match up. We want to see a lower low on higher RSI on certain key time frames that will indicate there is a lack of selling conviction on the pullback....so bullish divergence is one of the things we'll be looking for. That will give us a very high level of confidence in regards to which call spread we'll be choosing. I want to make clear that we'll be entering this call-spread trade with allocation tranches in mind. Our first allocation will be the most conservative. As the pattern develops we'll be further allocating into that call spread or depending on the depth of the pullback we will consider putting on a more aggressive & quicker call spread. We don't take that position until the pattern has matured and we have a strong sense of support and resistance levels within the larger context of this macro trend. So that's very important to distinguish.

You'll notice that the table is locked except for the highlight in turquoise. This highlight is the area of the table where you can play with various pricing that you may want to scout for should a discount unfold on this next pullback. As you change the "Price to Scout" column you'll notice the "Max ROI @ Scout Price" column adjusts based on what cost the call-spread is purchased at. You'll also notice the cost & gains values that the market is valuing each of those spreads at in real-time right from this table. Keep in mind that data pulls are limited to hourly pulls so there may be a slight delay in pricing.

The password to access this page has been SMS texted to Members.

Before accessing the table, please finish reading the entire post as this next analysis is fundamentally influential into how & why we're choosing our specific call spread. We'll highlight in a separate post which ones specifically we're targeting & why and send Members a notification soon about this. Right now it's important to still watch the setup unfold before committing to over-ripe or under-ripe spread.

↓

MACRO DIRECTION - FORECASTING AAPL's PRICE TARGETS

However, a very important point to distinguish is that AAPL is on the mature end of this macro bull cycle. How do we know that?

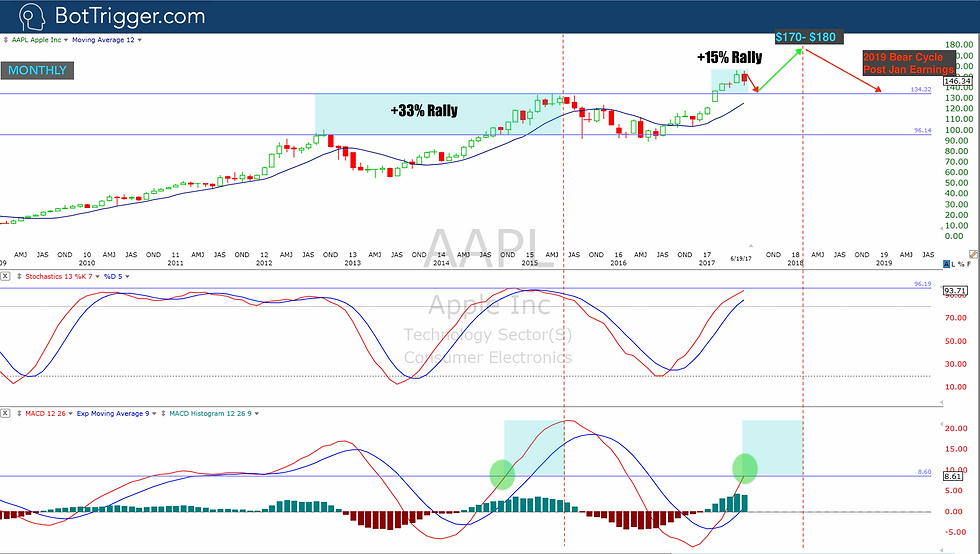

Well there a few angles of data that indicate this current macro bull cycle will sputter out post January earnings. We know that when we get bearish crossovers on monthly time frames on both Stochastics & MACD that it tends to almost always mean that the bulls are tired and AAPL starts a long & protracted corrective period. But take a look at the relative gains AAPL has made from the old 2015 pivot high. We're currently about +15% higher from the top of 2015 when AAPL reached $134.54.

Now take notice of the old pivot high of 2012 and how much further AAPL rallied after it revisited this area and broke out higher from that $100 level. The stock rallied +33% higher from the 2012 pivot high. So why is this important. Well it give you a relative scale on how much & fast valuation figures can be corrected /appreciated, that and it shows you the power of the crowd when the laws of inertia are in play. Now we start to see when this momentum is waning & topping out. We can see it well in advance on the macro time frames. Notably the monthly momentum oscillators start to curl in a bearish crossover.

Take a look at how far AAPL has rallied from it's 2015 pivot high.

So AAPL has traveled +15% higher from the 2015 pivot high of $134.54. If the prior gain increase from the pivot high of 2012 is any indication then AAPL can easily reach $170 to $180 per share before topping out in this next push. And when might we see that happen? Based on the time lapse of how much juice is left in the macro oscillators on both MACD & Stochastics...we can see where there currently at. In the pic above, notice the blue box in the bottom panel. It suggest that we could see the $170 to $180 level as soon as early January 2019 if not post Jan earnings. After that last push we should see AAPL significantly contract as YOY sales comps will be impossible to beat compared to January 2019 earnings. This happens every 2 years on clock. AAPL has it's new phone release....not the S form but an entirely different form factor and that has always caused a mother rally of epic proportions. Lately the market does the bulk of AAPL's rally BEFORE the release of the new form factor iphone release. A smaller rally usually after and then AAPL goes through a long bear cycle as the market prices in YOY (year over year) comps don't stand a chance to the earnigns yield accrued during the introduction of the new release. So we can see something very similar here.

Although we expect that the next bear cycle will be more shallow than the -33% drop we see in 2015 - 2016.

Here is an alternative view on potential price targets for AAPL's uptrend. There is both an aggressive & conservative target here that's illustrated.

The aggressive target is based on "Mirror Forecasting." We're not subscribing to this view. It's where you apply the gains of the prior rally and assume on the basis of that % increase that the same or similar % increase can happen in the next rally. This is more true in near time frames and less true as stocks get bigger in market cap or at least their relative speed in which the prior rally made it’s ascent is slower than the next rally cycle. You'll notice that AAPL rallied 144% higher off the 2013 bottom. A 144% higher move off the 2016 bottom would put AAPL around $220. We think that's too aggressive of an expectation that AAPL would double it's entire market cap in a year and half from the 2016 lows when the market cap reached a low of $504 Billion in May of 2016. A 144% increase from the low of 2016 would put AAPl at a market cap of 1.2 Trillion at share price around $220. That kind of valuation is surely in AAPL's future but we don't see it happening anytime in 2019

The 2nd method of price discovery in forecasting AAPL is based on the "Force of Rally" analysis.

FORCE OF RALLY = up swing % / prior down swing %

AAPL's 2013 correction took AAPL down -44% and then rally off those lows took AAPL up 144% higher. So we take those values to get the "Force of the Rally"

144 / 44 = 3.27 The rally of 2013 reversed the -44% correction by 3x. That “3x” number shows you the potential of capable power behind a stock that is “correcting the reversal” - like how much gas/power was used in the counter rally off the lows of 2013. This is a conservative method of applying forecasting to future moves. The aggressive method would be to assume that AAPL could mirror the 2013 & 2014 rally and go up 144% off the 2016 lows like it did back off the lows of 2013. If AAPL rallied 144% off the 2016 lows then the top would be somewhere near $220 a share. We’re not going to model for that. The conservative approach, and again this is just one forecasting method, is in modeling that since AAPL dropped -33% from the top of 2015 the potential force of the rally can reverse that - % drop by a factor of +3x (or 3.27x to be exact). So if we assume what power & behavior is potentially capable in this bull cycle of reversing a -33% drop by a factor of 3.27x in this current bull cycle, then we get an up cycle value of +107% potential gas. Which would put the stock around $185 before it runs out of gas. So that is all together possible and a much more conservative approach then just assuming that since AAPL rallied 144% back off the 2013 bottom that it could rally 144% here off the 2016 bottom. A 144% rally would put AAPL at $220 & a 1.2 trillion market cap before topping out. We’re not betting on that.