We expect this week that AAPL will be trending higher with a near-term top on the horizon where we should see some consolidation if not a small pullback. But our expectation is that AAPL will most likely be gaping up this Monday, if not Tuesday. We'll explain why in the post below. First off, let's address how we're going to deal with that and the opportunity that we have in regards to our March 100/110 Call Spread.

Note* For New Members:

March 100/110 Call Spread → 100% gain achieved so long as AAPL closes @ $110 or higher by March 2017 expiration - breakeven for this position is AAPL @ $105. To better understand how Call Spreads work please review our prior 2 post here: https://goo.gl/pHIAkJ & https://goo.gl/iFWRcZ

We may consider selling OR rolling-over our March 100/110 call spread when AAPL reaches the $115 level sometime this week. Yet there are important differences to address between selling all together vs "rolling-over" the spread into a longer dated expiration. So we'll address that. Lets first explain why this consideration is a good idea overall.

As of the close of Friday, the March spread is currently at a value of $7.80. If AAPL is trading around $115 a share there is a strong likely hood that position will be trading near about $9 in value. We bought this @ $5 even with the goal of accruing a 100% gain so long as AAPL closes at $110 or higher by March expiration. At a current value of $7.80 we're already around a 56% gain. Now if AAPL makes a run for $115 this week, which is our expectation...then we will probably have the opportunity to sell that position @ around $9. Selling @ $9 would be an 80% gain overall. The important distinction here is: at a spread value of $9, and with a max value of $10 → there would only be 20% left in the tank for further upside.

At that point, you have to really ask yourself if it's worth it to hold onto it and risk any type of shenanigans compromising the value that we've since accrued. I'd much rather sell that position and look to roll further out with the gains into a new call-spread that has more upside potential in the tank, buying on the next pullback or simultaneously rolling the spread over into a longer dated expiration which would be cheaper. For comparison purposes, take a look at the following spreads to get a feel for how they get cheaper when you roll farther out.

March 100/110 = $7.70 = 29.8% gain if AAPL reaches $110 by exp

April 100/110 = $7.38 = 35.5% gain if AAPL reaches $110 by exp

July 100/110 = $6.73 = 48.5% gain if AAPL reaches $110 by exp

July 100/110 = $6.23 = 60% gain if AAPL reaches $110 by exp

So there are 2 main advantages of buying into a new call spread whether on a pullback or simultaneously rolling-over.

1) We get more time and more runway for further upside appreciation

2) We protect ourselves with an upside hedge if AAPL breakouts or breaks-down:

Breakout Scenario → Then we're in a spread that can capture more upside gains

Breakdown Scenario → Then we're in a longer dated spread that can weather a recovery as it will have ample time to recover in value. If we stay in the March spread & AAPL breaks-down then the March spread will lose more value than the July spread on a %percentage basis.

At this point, we don't want to go into January earnings holding a March expiration because AAPL could very well fall short of expectations which would put short term pressure on the stock. Again, our expectation is that AAPL is more likely to breakout then breakdown and languish in this next oncoming quarter. Like there is an extremely high probability that AAPL will be trading well above $110 by March. But if we can get out with an 80% gain and then roll that spread over into an April or July spread that's cheaper with more time value and appreciation upside, then that's a no-brainer. The point is that we need to continually roll until we finally get to a point where Apple "comfortably" breaks out and we're in the money for the majority of a given quarter. When that happens, we make out big time. Here's why.

Suppose we're able to sell our March spread on Monday and then buy back into a July spread for the same price that we sold our March. Apple goes into earnings at $118 a share. Then suppose instead of Apple breaking down like it did in October, it breaks out and goes above $120. If by March Apple is trading well above $125 and testing its highs, then we'll have an entirely new July spread that we could capture for the same price we originally got into the March spread, with the same ROI (return on investment) profile of achieving a 100% gain. And this time we'll have far more cash to allocate to this spread overall. Again, you might ask....if AAPL is more likely to breakout then down, then why sell the March spread at all. The point is that our March spread is reaching near full value already. If AAPL will be trading at $115 anytime this week, then there's more value in selling that spread @ around $9 and then getting into an entirely new spread with more runway for upside appreciation. What we also get out of that is a hedge for upside protection. Like if AAPL is about to go primal and breakout higher, we want to be in a more advantageous position to capture the bulk of that move. Right now the March 100/110 spread is on track to getting fully tapped out. Inversely, to the other side of the hedge....if AAPL were to breakdown on January earnings, then being in a spread that expires in April or July will protect the value of our gains as it affords us a whole new time stretch of recovery, that and anything further out will take less of a beating than the spreads that are closer to expiration.

With Apple failing to reach that target on October earnings, by rolling to July ahead of January's earnings, we're put in the same position of safety. If Apple sells off then we're in the same place that we were in when Apple sold-off in October with a likely rally by the time we get to April earnings again giving us another 1 to 4-months and opportunity to roll out even further by the time we get there. So rolling over IS a strategy to employ with call spreads, especially if the upside left in that spread is getting close to full value.

Eventually Apple will take out the $120 level because the iPhone 8 is a game changer for Apple and the market knows it. It's a super cycle for the stock. Eventually its going to start rallying on the iPhone 8 rather than on the past. The market is forward looking. If the stock rallied up to $150 a share by February for example, that shouldn't surprise anyone because that would just be Apple rallying ahead of and pricing in the iPhone 8 just as the stock rallied 80% ahead of the iPhone 6 and then sold-off every quarter since the iPhone 6 actually launched. The market isn't going to wait for the iPhone 8 to launch and then rally. Most of the rally will be over by the time the iPhone 8 is actually announced. That was true with the iPhone One as it was with the iPhone 6. It's a super cycle and the market will eventually rally Apple well ahead of launch. So that is our strategy for now. We plan to sell at $115 and either buy back our Aprils with the intention of rolling on earnings or simply just rolling on this pull-back by purchasing a July spread instead of repurchasing April.

Moving on to the technical picture, we have been forecasting for weeks now that AAPL's trading behavior was setting up a perfect bottoming pattern on this inverse head & shoulder pattern.

So this pattern played out perfectly. From here we can expect the following targets towards the upside: $115, $116, $118, & $120 are the most probable levels of where we should expect to see. I'm not talking a straight shot as pullbacks are to be expected. What is clear is that we have cultivated a strong near term rally in the overall trend. On the high range of expectation, from this inverted H&S breakout we have a text book target breakout of about $120.50. Which is consistent with a revisit of it's ANNUAL HIGH back in December of 2015. Take a look.

Notice the annual high of $120 from back in December:

So much of this is further reinforcing our analysis on AAPL that 2017 will be a very strong year for AAPL.

So as we said a few days ago, Apple had only rallied 8% from its lows which was historically made it the smallest post-30-RSI rally in Apple's entire modern history going back to 2005. And that given what we've seen historically it's very possible that the 5-day pull-back we saw was just a pull-back within a two-legged rally that actually does rise to 11%. Well at this point it appears that it the case. Apple has now rallied 9%+ over 19-sessions. That is still within the normal range for these types of rallies. Remember, the time-period is between 3-5 weeks. We normally see these rallies complete in 15-25 sessions. Thus what we saw last week with Apple pulling back from $112.50 down to $108.25 was very much within the normal range of things if the stock simply rallied back. And in three sessions of rallying, Apple has now surpassed the highs. Take a look at the table below:

Now one thing to notice here is that 19-sessions is actually a tad bit not the long side for a mere 10% rally. On the high end of the sessions count we have had a 17-day rally, a 15-day rally, a 14-day rally and a 15-day rally. For larger rebounds, it isn't that long. When we've seen larger rebounds the session count can get up to 7-weeks. But it is still within the normal range of things.

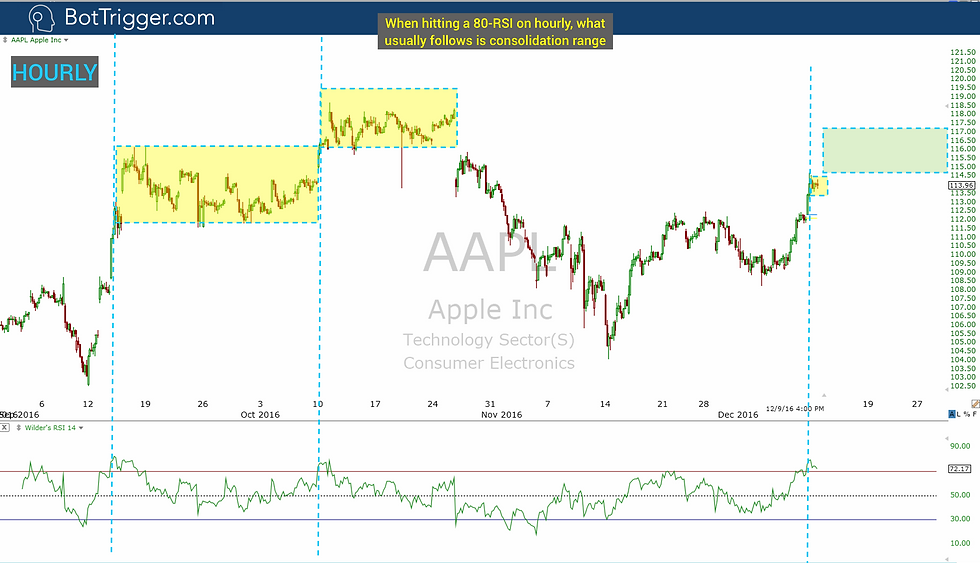

But here are some things to consider. Apple is now trading at a 76.5-RSI on the hourly chart. Chances are that if Apple hits an 80-RSI, it's going to stall out. Take a look at the chart below and this history goes further back. The vertical lines show when Apple first either hit a 80-RSI or when it came very close to first hitting an 80-RSI. When I say "first" I'm merely pointing out the first moments when it reached an 80-RSI (or close to it). You can see that there was still upside ahead, but after that the stock stalled out. So just because Apple hits an 80-RSI doesn't mean you immediately exit. In fact, what you're likely to see once Apple hits an 80-RSI is a small intraday pull-back with a gap-up the next day. So you're going to see Apple pull-back probably at the end of the session where it hits 80 and then gap-up the following day and run to significantly new highs above those 80-RSI price-levels. Then the stock will stall out and pull-back or consolidate for an extended period of time.

Notice that Apple being at a 78-RSI now puts it within striking distance of reaching that point. You can expect something like a stall out here around the $114 level, a sharp pull-back of some kind and then a gap-up to peak at $115. That makes the most sense to me all around. And the reason we should expect a peak at around $115 is for multiple obvious reasons. First, that's the gap-line. So it makes sense to peak there. Second, the we need negative divergence before Apple pulls back. Third, the $115.50 level marks the 11% rally point which completes the rally. If that were to happen tomorrow, that would make this a 20-day and 11% rally which would complete the run. Fourth, Monday is the start of a new trading week. So to see Apple gap-up to new highs on Monday and then stall out for the rest of the week makes a tremendous amount of sense.

Thus, what I propose doing is this. If Apple rallies to $115 on Monday, we're going to exit our March spread. Especially if Apple reaches an 80-RSI today. Apple reaching an 80-RSI today is the biggest signal to sell on Monday. It could be a bigger lay-up based on history. Apple could shoot the moon and run to a 90-RSI, but we simply cannot bet on that outcome. It's just never a likely scenario. Also the markets are super overheated. It may make sense to sell today. If Apple reaches $115 today, we're out for sure. There's just too much resistance at that $115 level.

now I want to address something. I want to remind those of you who bought too much into the fear side of things to remember what we saw here. Apple was going to take one of a few possible paths and all lead to Apple rallying back up to $120+ by the time we got to April expiration. First, if Apple had continued to sell-off passed the $108 level, it would have reached a 30-RSI at around the $105.95 level -- that was the pace even with rebounds -- and so it would have then VERY LIKELY double-bottomed at the $104 level. That would have set-up a gargantuan rally. The measured move on breakout would have been $8 above $112 which equals $120 a share. So that was one possible outcome.

The other possible outcome was Apple would reach a 20-RSi down near $100 a share and lead to the same result. A 20%+ rally over a 5-7 week period which puts Apple at $120 by late February or early March. And notice that 20-RSI analysis has NEVER FAILED Apple. It has happened every time and in every single market going back to 2005 (I haven't checked earlier than that).

Another possibility was that Apple would simply bottom at $108 -- an area of support for the stock -- and then rally up to $115. Those were the scenarios I drew up. And the reason I was very confident about holding our position was because I knew that one of these scenarios was going to play out. That Apple goes through a time-cycle and that this correction couldn't have come at a better time for our position.

Think about it. This correction started the VERY NEXT DAY after we rolled our January spread into April. You couldn't have asked for a better timing for a correction on a roll-over. That was basically perfect timing. What we didn't happen is to be holding our position and then see the correction begin today. That would have made things tight. We would have had to go through the entire pull-back, bottoming period and rally period. It would have probably still worked out but the targets would bring us close to expiration day.

So I think its important for those who were too caught up in the fear -- I received several concerned e-mails form people -- to realize that the reality of the situation. Because really in the end the biggest hurdle to overcome is the fear. The table tells us Apple rallies x-% over a y-period of time but doesn't give us any indication of the volatility or mind-games the market will play during that process. And here we are again with another statistic on the table that says 10%-rebound over 19-days. But it doesn't tell us how much fear and worry was induced over that period. The point here is this. Don't buy into the fear, go by the data. Trade this like a robot. The data couldn't be anymore clear that the most likely outcome for Apple over the next 3-4 months was that it was going to see $120 with at least a 90% certainty. You would have to have the 20-RSI analysis fail you for that to not happen. You would have to have time cycle fail and those two things have never happened. They're not happening now. Apple is at $114.50 a share which puts us at a 10% run now.

So Apple has now reached an 82.79-RSI on the hourly. This typically means that today will mark the day before the top in the stock. We should see a pull-back intra-day with a big gap-up on Monday with a peak on Monday or Tuesday.

Setting aside for a moment the overbought conditions on the hourly chart and what that has historically signaled, the daily chart looks aggressively bullish. I mean we have a HUGE candlestick sticking out above heavy resistance. Apple has broken far above its $112 resistance and far above its $112.35 50-day moving average. The bar sticks out like a sore thumb and looks more aggressive than the selling we had after earnings. This is an explosive move relative to the action we've seen over the past two-months since earnings. It leads me to believe that Apple wants to go back to the highs. That's what the daily chart says. Again, the hourly says Apple is likely to consolidate after Monday. That we're going to see a repeat of the action we saw back in mid-September. We had a day like this back in September where Apple reached very overbought conditions and then the following day it had another massive up day before then consolidating for what was about 16-sessions. Take a look at the chart below. Compare today's action to the day I have marked with a blue arrow on the chart. Notice how we had a huge up day followed by another big up day followed by weeks of consolidation. That's exactly what I'm expecting will happen here. Apple will gap-up Monday but then consolidate all the way through the end of December followed by an aggressive rally back to the highs by earnings in January:

Notice the two blue arrows. Imagine if you had not seen what came next. Looking at that, one may have concluded Apple was going straight to the moon. I mean this thing was skyrocketing with some extreme momentum. In just four-days Apple rallied from $102 up to $115 a share. In FOUR DAYS! That's extreme momentum. That's over 12.5% in four-days. Seeing that one may have concluded to the moon Apple goes. But instead Apple spent 16-sessions consolidating before finally struggling on its run-up to $118.30. And it was a struggle. Nearly every session was a black bar reversal day. Meaning Apple reversed its gains in every one of those sessions and closed below its opening price. This means that the entire run from $112 up to $118 was mostly due to gap-ups rather than intraday buying. That's the worst type of rally. The point is that Apple struggled after reaching an 80-RSI on the hourly and it should be taken seriously. Even though the daily chart looks strong. It looks explosive and strong here. Everything on the daily chart suggest Apple wants to go right back to the highs period. There is no counter argument on the daily at all. If we were basing our conclusions exclusively on the daily chart, we would say with 100% conviction that Apple was going back to the highs. That's how strong it looks. Here's how that September rally looked like without the consolidation that IMMEDIATELY followed. One would have thought "holy cow this is a parabolic rally." This looks every big like a parabolic run. But with Apple reaching an 80-RSI and higher, it then lead to consolidation.

Here is the big point in all of this. Suppose we sell Apple on Monday at $115.50 and the stock then runs to $118. It doesn't mean it was a bad decision. With the information we had at the time i.e. now, the best informed conclusion to be drawn here is that Apple will struggle with $115 resistance and pull-back based on the 80-RSI analysis. Now I will go back and do more of this analysis and see how things shifted from an 80-RSI run to a 90-RSI run, but in the last 2-years, nearly every time Apple hits an 80-RSI, it's a top. And sometimes a brutal top. There were times that if you hadn't sold at an 80-RSI, you were immediately in for a 10%+ sell-off. So we'll review that over the weekend. I'll probably post a BC Weekly summary this weekend as it will be very important to devise a strategy.

Now let's discuss exit strategy. First, it's important to understand that once you get a run like this, you will have a lot of time to exit. It's rare to see a multi-hour strong run peak and then immediately fall back. That rarely if ever happens. What you see instead is a period of consolidation that leads to a top. For example, if Apple were to peak here at $114, you would first see the stock spend like 10-15 hours trading sideways in and around these levels first. Take a look at the hourly chart below. Notice how each peak takes several hours to complete. It's rarely ever a peak and then sell-off:

These yellow boxes are just an example or illustration of what I'm talking about here. Notice how Apple spends time at certain levels before peaking and then pulling back. Here are a few more going back 6-months:

And if you go further back still you will see the same recurring theme. It takes time for Apple to peak after a run. The point here is this. You don't have to rush to the exits the very second Apple reaches an 80-RSI. There will be time to exit. If you look at every time Apple has reached an 80-RSI or close to it, or rather if you look at each time Apple reached its PEAK RSI level, the stock price almost always goes higher after that point. The RSI peak is seldom if ever the stock price peak. So for example, Apple hit an 80-RSI today. If that represents the top for the RSI, it's unlikely that this will represent the stock price top. Chances are you will see a peak above those levels. So today's high of $114.70 will likely be eclipsed at some point because that was the point at which we saw a peak in the RSI. If the RSI goes even higher still, chances are the stock price will trade at levels above the point at which it reached that RSI peak. This rule of thumb is ESPECIALLY the case whenever Apple hits an 80-RSI. It's not uncommon to see Apple reach 70-RSI for instance and peak at those levels. That happens. But when you see strong momentum like this with Apple hitting an 80-RSI on the hourly, while the RSI may peak, the stock price moves higher for hours after that point.

What I might expect to see here is Apple's RSI come down to like the 60-level, rebound to the 72-level with Apple's stock price $1.00+ higher than where it was when it first peaked. That's the typical outcome.

But even if we don't get that type of divergence, we should still have plenty of time to sell in and around these levels if need be. We should expect Apple to trade around the $114 area for least a good 5-10 hours.

Now let's move on to the broad market. First, let's take a look at the QQQ's. So as we said a few days ago, one very strong possibility was that the QQQ's would go back up to $119.50 a share. That historically speaking, we've seen $4-$5 rebounds off of a 20-RSI. In fact, that was the MOST COMMON outcome with the more rare outcome being a mere $2.00 rebound.

But here's where things stand now. The QQQ has completed a very massive inverted head & shoulders continuation pattern. It's not a bottom because the pattern is happening in an uptrend. But it is still bullish. We saw the SPY do this ahead of QE3 and it exploded higher.

We could be setting up here for a gargantuan rally in tech. And this makes a lot of sense because tech has largely underperformed. So you would expect that tech may fuel the next legs of the Trump rally. Just like how the $IWM lagged when others were breaking out all throughout the summer, we now have the IWM breaking into now highs along with the DJIA & SPY. Take a look at the QQQ chart below:

Now that is the hourly chart. The QQQ's are barely even overbought. The QQQ's have room to go much much higher without issue. Hell the QQQ's are nowhere near overbought on the daily chart:

So you can see here how the $120 level is the huge line of resistance for the QQQ's. And as we said before, the upside target on breakout is $127. Don't think it could get there. Just take at the SPY. It certainly can and will if the QQQ's breakout above $120. That will put huge pressure on Apple which should take Apple back to its highs by earnings. Remember, our intention to sell Apple is not an intermediate-term outlook. It's a short-term play. I just expect that option prices will contract if Apple spends 2-weeks consolidating. But my expectation is that Apple will bust right through $115 and go back to its highs by earnings.

Now let's move to the SPY which is much juicier. The SPY has been an absolute monster. We're now very overbought on the SPY but it's important to understand that the SPY just broke out above what is nearly 2-years of heavy resistance at the $210 level. So I would expect to see exactly this reaction once the SPY broke out. That's why we were targeting $230 or even $240 for a longer-term target on breakout. Right now the SPY is sitting at a 76-RSI on the daily chart signaling very strong momentum ahead. The $NYMO has pushed up to the 61-level suggesting this is a fairly broad based rally. The $NYMO is an important index indicator that measures momentum as a ratio value of the number of advances less the number of stocks declining, in conjunction with breadth thrust. We've covered this one multiple times as it's one of the core indicators that gets calibrated into how we derive market signals. In respect to this chart below, when decliners get to extreme lows, it tells you that the market as a whole is due for a counter trend reversion to the mean. In other words, relative sale value is at an extreme discount to where the markets been and the buying phase as we've seen historically is an inevitable outcome. All this is important to grasp when you're in a confirmed uptrend. Relative discount values are opportunities. Take a look below since 2014, anytime the $NYMO has gotten this low, we've ALWAYS seen a counter trend. In bull markets that's what you can expect:

The hourly chart is even more impressive. The SPY has reached a 90-RSI. That's a big deal. Yes it probably signals that we're in for a big pull-back short-term, but after that I expect to see more highs ahead. Remember, we need negative divergence on the SPY before any major top is in. In fact, I wouldn't be surprised to see this rally continue up into Trump's inauguration. The reason the market is rallying so hard right now is because Wall Street feels it has Trump's ear. That Wall Street will be able to make a lot of money under his administration. They view his presidency and his Wall Street appointments as being dovish to the markets. So I would't be surprised to see this rally continue on into January and at least through year end with maybe a small pull-back in-between.

So back to AAPL, here is our outlook: Our expectation is that Apple will peak somewhere near $115 a share. That makes the most sense. It's a test of the gap-line, it follows the same historical pattern for the 30-RSI rally target (on the low end) and it follows the momentum divergence rules. Everything is pointing at a peak near $115 a share on a final surge. Then after that, I expect we see some sort of consolidation period on the back of the market perhaps consolidation. And that period could last a few weeks and into the new year. Then after that, I expect that sometime around the end of December or beginning of January for Apple to go on a pre-earnings run back to its highs near $118 a share.

We may consider selling our March 100/110 call spread when AAPL reaches the $115 level sometime this week, and then buy-back perhaps the April or July spread on the next pull-back. If AAPL is trading around $115 a share there is a strong likely hood that position will be trading well close to $9. We bought this @ $5 even. So if we can sell @ $9 that's an 80% gain overall. At a spread value of $9 there's only 20% left in the tank for further upside. At that point, you have to really ask yourself if it's worth it to hold onto it and risk any type of shenanigans compromising the value that we've since accrued. I'd much rather sell that position and look to roll further out with the gains into a new call-spread that has more upside potential in the tank, buying on the next pullback. We don't want to go into January earnings holding a March expiration because AAPL could very well fall short of expectations which would put short term pressure on the stock. Again, our expectation is that AAPL is more likekly to breakout then breakdown and languish in this next oncoming quarter. But if we can get out with an 80% gain and then roll that spread over into an April or July spread that's cheaper with more time value and appreciation upside, then that's a no brainer. The point is that we need to continually roll until we finally get to a point where Apple breaks out and we're in the money for the majority of a given quarter. When that happens, we make out big time. Here's why.

Suppose we're able to sell our March spread on Monday and then buy back into a July spread for the same price that we sold our March. Apple goes into earnings at $118 a share. Then suppose instead of Apple breaking down like it did in October, it breaks out and goes above $120. If by March Apple is trading well above $125 and testing its highs, then we'll have an entirely new July spread that we could capture for the same price we originally got into the March spread, with the same ROI (return on investment) profile of achieving a 100% gain. And this time we'll have far more cash to allocate to this spread overall. Again, you might ask....if AAPL is more likely to breakout then down, then why sell the March spread at all. The point is that our March spread is reaching near full value already. If AAPL will be trading at $115 anytime this week, then there's more value in selling that spread @ around $9 and then getting into an entirely new spread with more runway for upside appreciation. What we also get out of that is a hedge for upside protection. Like if AAPL is about to go primal and breakout higher, we want to be in the best position to capture the bulk of that move. Right now the March 100/110 spread is on track to getting fully tapped out. Inversely, to the other side of the hedge....if AAPL were to breakdown on January earnings, then being in a spread that expires in April or July will protect the value of our gains as it affords us a whole new time stretch of recovery, that and anything further out well take less of a beating than the spreads that are closer to expiration.

With Apple failing to reach that target on October earnings, by rolling to July ahead of January's earnings, we're put in the same position of safety. If Apple sells off then we're in the same place that we were in when Apple sold-off in October with a likely rally by the time we get to April earnings again giving us another 3-months and opportunity to roll to October. Eventually Apple will take out the $120 level because the iPhone 8 is a game changer for Apple and the market knows it. It's a super cycle for the stock. Eventually its going to start rallying on the iPhone 8 rather than on the past. The market is forward looking. If the stock rallied up to $150 a share by February for example, that shouldn't surprise anyone because that would just be Apple rallying ahead of and pricing in the iPhone 8 just as the stock rallied 80% ahead of the iPhone 6 and then sold-off every quarter since the iPhone 6 actually launched. The market isn't going to wait for the iPhone 8 to launch and then rally. Most of the rally will be over by the time the iPhone 8 is actually announced. That was true with the iPhone One as it was with the iPhone 6. It's a super cycle and the market will eventually rally Apple well ahead of launch. So that is our strategy for now. We plan to sell at $115 and either buy back our Aprils with the intention of rolling on earnings or simply just rolling on this pull-back by purchasing a July spread instead of repurchasing April.